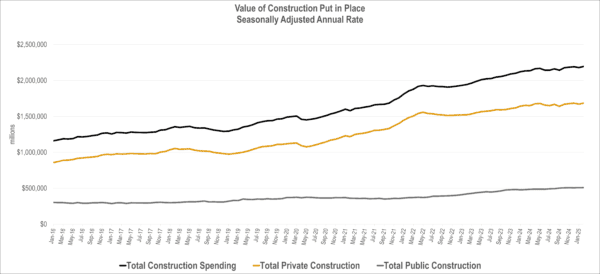

The U.S. Census recently released the results of its monthly Value of Construction Put in Place Survey. The survey provides estimates of the total dollar value of construction work done in the U.S., including data on design and construction spending for public and private projects.

The seasonally adjusted annual rate of $2.19 trillion for February 2025 represents a monthly increase of 0.7%, and a 2.9% increase year over year. This growth reverses last month’s decline, which due to revisions was -0.5%.

Private construction increased 0.9% month over month while Public construction increased slightly at 0.2%.

Source: US Census Value of Construction Put in Place Survey April 1, 2025 release

The reversal of last months’ decline supports the overall uncertainty that has hit U.S. markets and the economy over the past few months. This month, overall economic growth was revised to 2.4% for the 4th quarter of 2024, an increase from the previous 2.3% estimate.

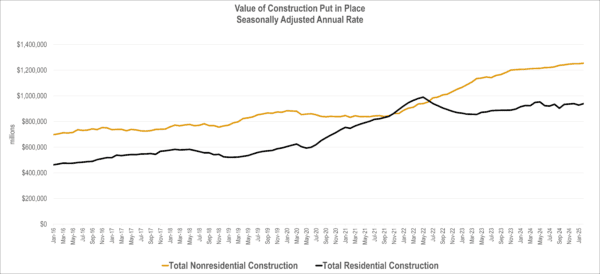

The overall slowing of topline growth masks the underlying variance of sector specific growth. Factors such as “higher for longer” interest rates, changes in fiscal policy, and other economic uncertainty account for this variability. The residential market rebounded from last month’s decline to grow at 1.3% month over month. The nonresidential market showed an increase of 0.3%.

Source: US Census Value of Construction Put in Place Survey April 1, 2025 release

With respect to year-over-year growth in individual markets, the start of 2025 shows a shift in what markets are growing vs. which declined compared to the previous three years. The Water sector saw growth in both Supply and Sewage & Waste Disposal. Education exited the top growth markets, while Amusement and Recreation continues to see strong growth in the Sports Facilities and Performance Center subsectors. Transportation is also a top growth market due to the increase in Air-Related Construction.

For the sectors with the lowest levels of growth, Commercial continues to see declines due to interest rate sensitivity and other secular trends affecting demand, while Highway & Street and Health Care see consecutive months of negative growth. The last time these sectors had sustained low to negative growth was early 2021.

The Office sector is no longer in the bottom performing category due to Data Center growth which is up 38.8% year over year.