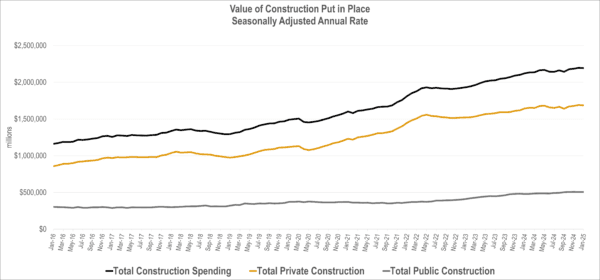

Recently, the US Census released the results of its monthly Value of Construction Put in Place Survey. The survey provides estimates of the total dollar value of construction work done in the U.S. This data includes design and construction spending for public and private projects.

The seasonally adjusted annual rate of $2.19 trillion for January 2025 represents a monthly decline of -0.2%, and represents a 3.3% increase year-over-year.

Private construction declined -0.2% month-over-month while public construction increased slightly at 0.1%.

Source: US Census Value of Construction Put in Place Survey March 3, 2025 release

The overall slowing of construction spending is to be expected given the significantly above-trend growth of the previous few years post-pandemic. This is in line with overall economic growth which grew at 2.3% for the 4th Quarter of 2024, a decrease compared to the 2nd and 3rd quarters of 2024.

EXPLORE THE DATA WITH OUR NEW INTERACTIVE DASHBOARD

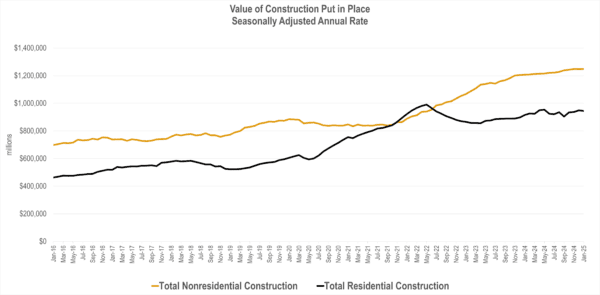

The overall flattening of topline growth masks the underlying variance of sector-specific growth. Two factors – higher for longer interest rates and changes in fiscal policy – account for this variability. The residential market continues to weather higher mortgage rates, though its resiliency is waning, showing a -0.5% decline month over month. The nonresidential market showed a slight increase at 0.1%.

Source: US Census Value of Construction Put in Place Survey March 3, 2025 release

With respect to year-over-year growth in individual markets, the start of the year shows a market shift in growing markets versus declining markets. The Water sector saw growth in both Supply and Sewage & Waste disposal. Education entered the top markets, while Amusement and Public Safety continue to see strong growth. A noteworthy change is that this is the first time Manufacturing did not see double-digit growth since the fall of 2021.

For the sectors with the lowest levels of growth, Lodging and Commercial, continue to see declines due to interest rate sensitivity while Highway & Street and Health Care see negative growth for the first time since the spring of 2021. It is unclear how much of this is due to fiscal policy changes.

The Office sector remains slightly positively supported by Data Center growth at 46.4% year over year.

—

Want to shape the future of the data ACEC tracks and creates for its members? Now’s your chance! By signing up for the Market Intel Committee, you’ll:

- Identify and analyze key market trends and developments.

- Recommend valuable resources and cutting-edge educational programs.

- Share insightful market intelligence with your peers.